5 Easy Ways to Be More Productive TODAY

Productivity.

Have you ever had one of those days where you sit down in front of your computer at work and suddenly it’s lunch time and you’ve barely gotten through all your emails? Or when you get home and sit down for “just a moment” to relax and suddenly it’s time for dinner? I feel like we all have these dilemmas that make us feel unproductive.

Which brings me to the point of today’s post. Today I will give you 5 easy things you can do to instantly boost your productivity at work or at home. Let’s jump in:

1. Get Up!

Whether you are sitting at a desk at work or sitting on the couch at home, you need to get up. It has been proven that people who exercise on a daily basis are more productive than those who don’t. So take a walk around the block, go to the gym during lunch, or even just take a lap around the office. The important thing is to get your body moving in order to kickstart the rest of you.

2. Conquer Your Tough Tasks First

It is easy to waste your morning on mundane tasks, but if you decide to focus on your hardest task of the day first, you are more likely to complete it (and everything else on your list) sooner.

3. Take a Break

When you feel like you’re hitting a wall, stop! Taking breaks is actually a good thing. Someone who takes short breaks throughout the day will be far more productive than someone who stays chained to their desk. Sometimes your brain needs a break in order to find out a new way to do something, so do your brain a favor and take it.

4. Stop Multitasking

At this point, we have all been told that multitasking is actually less productive than focusing on one thing at a time and yet, for some reason, we keep multitasking. Make an effort to focus on at least your main tasks on a one-by-one basis.

5. Build a Routine

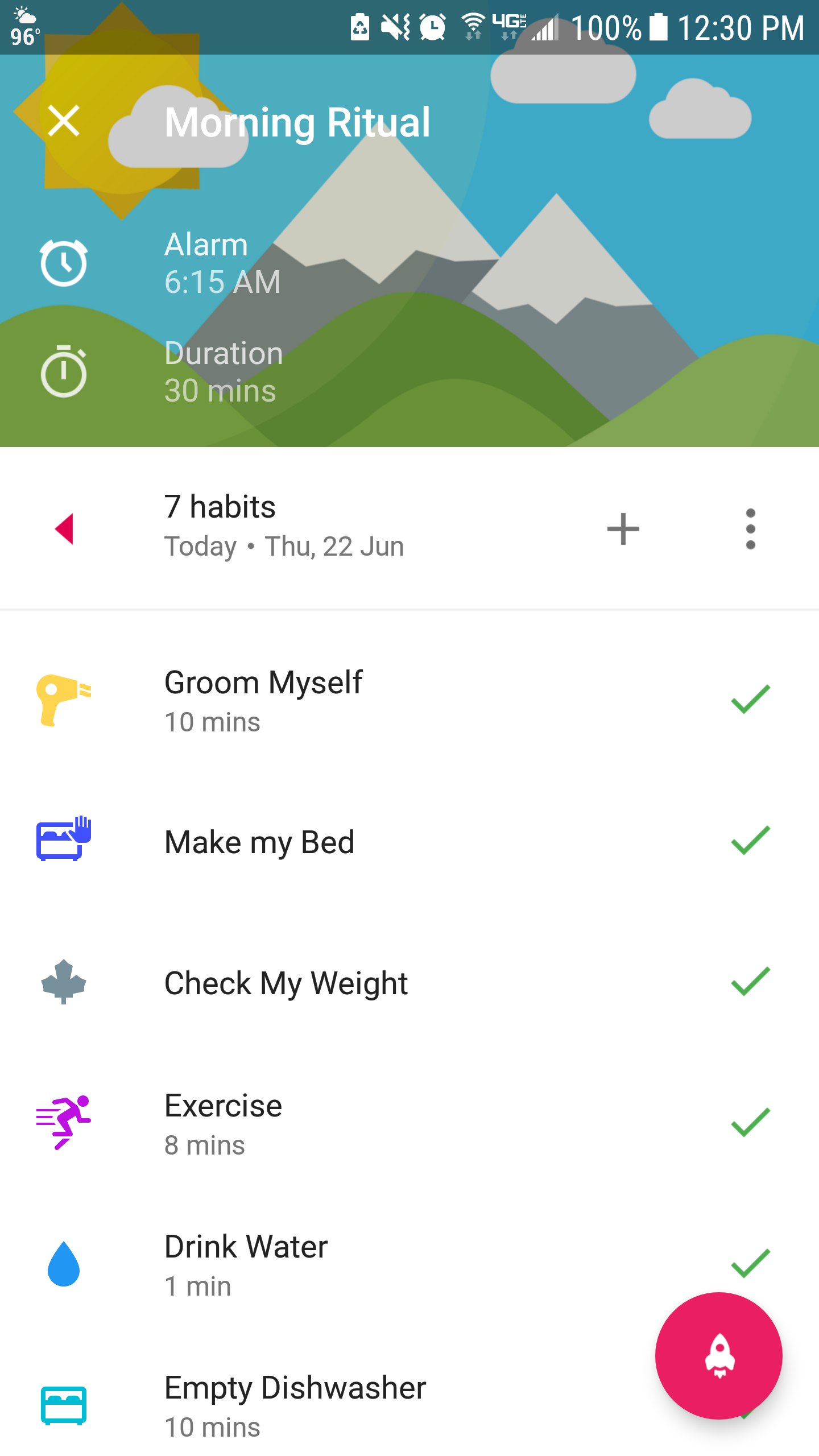

Making something routine is a great way to boost productivity. You can make it part of a routine to take breaks, stop multitasking, or even focusing on hard projects first. When it comes to my personal routines, I have a secret weapon and today I am going to share it with you!

My secret weapon is an app called Fabulous. This app helps you turn anything into a routine. From making your bed each morning to blocking out distractions at work, Fabulous can help (and the best part is that it’s entirely free)!

For example, I have a set of 7 “habits” that I complete each morning. The app starts with an alarm at a certain time each morning. That’s when you start your “habits”. There is a timer for each habit and once the habit is complete you click a big, satisfying button. Once you have made it through your routine the app congratulates you and you continue with the rest of your day. Try it for a few days and you will see just how productive (and fabulous) you can become!

6 Habits of Conscious Organizations

“It’s as if I was watching myself be a jerk!”

The VP sitting in my office is distressed and embarrassed as he is telling me about his recent conversation with a talented engineer. “Dave, this is great news!” I say excitedly, and he stares at me as if I went off the deep end.

My favorite definitions of consciousness are “the fact of awareness by the mind of itself and the world” and “the quality or state of being aware especially of something within oneself.”

Creating organizational consciousness takes practice and the adoption of consciousness-building habits. Here is the first installment of “6 Habits of Conscious Organizations” to support you in creating conscious work environments.

1. Awareness

First things first, and that means awareness.

Why was I so excited by Dave’s statement you ask? Consciousness begins with awareness. Awareness leads to taking appropriate actions as illuminated by the newly found awareness.

Dave (a highly gifted engineer himself) was widely known to be rude and offensive at the office, without realizing the pervasiveness of his behavior or its impact on others. Once he became aware – and able to see himself “being a jerk” – changing his behavior became a much easier task.

John Renesch defines conscious organization as “one that is continually examining itself, committed to becoming as self-aware and responsible as it can at any given time in its life. Becoming conscious is becoming aware of something, then acting responsibly in light of the new awareness.”

2. Compassion

According to Thomas Merton, “compassion is the keen awareness of the interdependence of all things.”

When I am making choices grounded in the awareness that we are all connected, the impact of my business decisions moves beyond the shareholders, stakeholders, customers, suppliers, or employees. I start looking at it from the holistic point of view – what is the impact of my choices on my community and the world.

Blaine Bartlett, CEO of Avatar Resources Inc., speaks of compassion as the distillery of choices that has the potential to change the nature of how we conduct business.

Compassion is predicated on the notion that everything is connected. So trade-offs – where we make a business decision in favor of a certain stakeholder group at the cost of another stakeholder group – are not an option.

3. Conscious Communication

To raise consciousness, we have to alter our way of speaking and communicating so that everybody feels safe to communicate authentically, and everybody gets heard. Once we become truly aware of the differences in peoples’ mindsets, approaches to life and beliefs, we can actually begin to appreciate how similar we are in our deepest needs and desires. Seeing those commonalities allows the development of deep trust and kinship. This enables the kind of authentic and courageous communications which cause conscious leadership and conscious organizations.

4. Mentoring

In the regular course of business, knowledge transfer does not often happen in organizations. Busy supervisors don’t take the time to create organizations of learning, discovery, and understanding. That’s where mentoring comes in.

Mentoring accelerates and develops cultural assimilation. Through developing ongoing relationships with their mentors, everyone in the organization more fully understands and embraces company values and culture.

As mentors and mentees spend time together, they build a network of strong relationships between people in different segments of the organization…and discover leaders in the organization they can count on for support.

Mentoring provides a unique opportunity for employees to build a bond with senior leaders they otherwise would not have even met, and benefit from their wisdom. This builds alignment, camaraderie, and an experience of common purpose. Both mentors and mentees become more self-aware and better versions of themselves.

Mentoring supports mentors and company leaders to have a finger on the pulse of the organization, and be more connected to the organization as a whole. As we teach, we learn.

5. Responsibility

Being a victim is not allowed. Neither is being defensive and placing blame. Everyone takes 100% ownership of the situation.

This is my favorite definition of responsibility:

“Responsibility begins with the willingness to take the stand that one is cause in the matter of one’s life. It is … a context from which one chooses to live. Responsibility is not burden, fault, praise, blame, credit, shame or guilt. In responsibility, there is no evaluation of good or bad, right or wrong. … Being responsible starts with the willingness to deal with a situation from the view of life that you are the generator of what you do, what you have and what you are.”

— Werner Erhard

A few more words from the wise:

“You must take personal responsibility. You cannot change the circumstances, the seasons, or the wind, but you can change yourself. That is something you have charge of…”

— Jim Rohn

“All blame is a waste of time. No matter how much fault you find with another, and regardless of how much you blame him, it will not change you.”

— Wayne Dyer

“The price of greatness is responsibility.”

— Winston Churchill

“Success on any major scale requires you to accept responsibility… in the final analysis, the one quality that all successful people have… is the ability to take on responsibility.”

— Michael Korda

6. Working Smart

Working smart increases velocity, produces synergy, and creates exponential growth.

It allows us to move through our day with more focus, awareness, and purpose. See Work Smart. Work Consciously. for ideas for working smart. Try them on and see what fits best.

A few last words about creating conscious organizations.

Claudia E. Mino, Ph.D., VP of Organizational Development at Carrington Mortgage Holdings, notices a strong correlation between the health of the environment you work in and the wellness of people’s personal lives, health of their families, and their general life satisfaction.

A conscious environment absolutely translates into better family life and better personal life. Provide a happy environment so people thrive and you’ll see conversation at home and at happy hour change from complaining to empowering.

That alone, and in turn, translates into more effective, productive, successful, and empowered people producing extraordinary results.

How are you creating a conscious organization?

Battle Price

“A more peaceful way to live is to decide consciously which battles are worth fighting and which are better left alone.”

– Richard Carlson

I’m sure I’m the only one who has sat on a customer service line for 30 minutes or more to correct a billing error or get a refund. NOT!

My most recent experience had me realize I was spending $300 worth of my time to save $30. Insanely bad time management.

Some of us are smarter about this than others. Until recently, I fell into the not-so-smart.

Perhaps there’s some ingrained “stand up for justice” orientation that was ingrained from my childhood experiences or, on the other hand, some self-appointed, Corporate Correction Czar-ness that I picked up in early adulthood, whereby customer service and experience became my torch (thank you Tom Peters). Or, maybe I just blindly want to save a buck.

Yet, the price of the discombobulation that the energy and friction endured to reach that justice-for-the-right, in-search-of-excellence reset, or extra buck is often not worth it.

New awareness, patterns and ways of being are always called for if we’re going to keep growing, and especially in The Back Forty. We can’t keep doing things the same old way if our charge is to free ourselves up to play the Big Game we came here to play.

If the first half of life was only R & D, research and development, for us to now do what we came here to do, we want to be getting lighter, not more entrenched in nitter natter. We should (me, myself, and I) consider letting go of things that aren’t so valuable for those that are. Like peace.

There are people and events in our lives and workplace, businesses we frequent, and family and friends we spend time with during holidays that seem to always stick something in our craw.

Do we grab every opportunity to be right and support the justice of humanity? Only if we want to be a wreck.

‘What price peace?’ is a good question to keep asking ourselves in living every day as our best day, and especially in the lightening up process of gearing up for our Big Game Back Forty future.

Am I encouraging rolling over all the time? Perhaps not. Perhaps there’s a battle that must be fought. And yet, not every single one.

It’s been said that sometimes we need to lose the small battles in order to win the war.

Perhaps sometimes we need to simply let go of the small battles to enjoy peace of mind, body and spirit.

What battle can you release and forego today for the pricelessness of your Back Forty peace?

“Don’t let something that doesn’t matter cause you to lose something that does. ”

– Anonymous

Agile

“If nothing ever changed, there would be no such things as butterflies.”

-Wendy Mass

Things are going to change. Jobs will be gained and lost. Loves will be embraced and released. Businesses will thrive and dissolve. Residences will be moved into and out of. Health, finances, plans, will go this way and then that.

Change is the thing we aren’t naturally programmed for because the internal, stay-safe, survival mechanisms are geared to kick in when “different” shows up.

Let’s say you usually spend all day in an office. Boom! Layoff, and you’re now home. Or you’ve been in a relationship for years. Boom! It breaks up. Or, yes, even those who haven’t been in a relationship for years…Boom! You’re in one!

We can go through the above scenarios for any aspect of life. The question is: how to adapt most effectively.

The first hurdle is the commitment to actually adapt. Many hold onto the old system, pattern, situation like a child attached at the hip to a parent on the first day of kindergarten. We’ve probably all read “Who Moved My Cheese?” and yet a commitment to embrace and adapt to change isn’t always our first reaction.

The second element is to understand and embrace agile. Agile is not only a descriptive of someone nimble and quick, but a term used in the world of software development where the focus is on quick adaptation based on short and regular reassessments of the situation and what is wanted and needed. But they get the product out NOW…not when it’s perfected.

There’s a lot of relevance to this concept for our own lives in The Back Forty. Guess what? Shift happens! And it tends to take on greater seeming impact and significance as we move into the second half of life.

Taking on the agile way in which those in the first half – the 18, 20, 25yr olds – simply play and learn and play and learn some more can support us who have “been around the block a few times” loosen up, commit to adapt, and by God even start to have fun with it!

Giving up the expectation that anyone or anything will stay the same or that, in adapting, we’ll “get it right the first time” allows us the patience to stay on the playing field…with an emphasis on “play“.

Try a new approach? Conduct an experiment? Design a new context within which to hold it all? Any of these can be forward-falling directions to take so as to flow with the shifting winds of life. And falling forward fast is what will get us doing what we came here to do…not waiting until everything is stable.

Where can you bring playful and agile adaptation to changing plans, people and places in your Back Forty world today?

“Success today requires the agility and drive to constantly rethink, reinvigorate, react and reinvent.”

-Bill Gates

4 Ways Investing During Midlife Can Make You a Millionaire

A survey conducted by Bankrate recently fount that over 30% of people between the ages of 30 and 49 haven’t even started saving for retirement. If you fall into this bracket, the sooner you start to invest, the better! Why, you ask? Because you are also earning the bulk of your income between your late 30s and mid 50s.

How do I start? What should I do? No worries, I’ve got you covered. Here are my top four tips for helping you make the most of investing before retirement.

- Set up a financial plan: You can do this yourself or use an advisor, but often advisors can help keep you on track when you would be tempted to buy that new car you don’t actually need.

- Invest in the stock market: If you are in your 30s or 40s, invest in moderate risk stocks. If you are in your 50s or 60s, invest in low risk stocks. Also, make sure to diversify your holdings. Don’t JUST focus on stocks. Make sure to also invest in things like bonds and real estate. People who retire with seven or more types of investments have an average net worth of $1.4 million while those with three or less types of investments have an average of about $670 thousand.

- Prioritize retirement over college: I want to help my kids pay for school you might say. But let me put this in perspective, you can borrow money for college, you can’t borrow money for retirement. Plus, your kids can also receive scholarships and grants for their schooling. If you want to start a savings plan for your kids as well, go ahead. Just make sure that you aren’t sacrificing your own retirement plan for their schooling.

- Switch up your investment goal as you age: When you are in your 30s and 40s make sure that your goal is to grow your capital. You will have a slightly more aggressive approach than when you get older. Once you reach your 50s, you should shift your investment goal to conserve your capital. Start shifting to safer stock options. The last thing you want is to watch the risky company you invested in to go down the tubes.

Ultimately, if you are currently 40, follow the above steps, and invest about $1,500 a month at a 6% annual return you can be a millionaire by the time you reach retirement! It might not be easy, but I believe you can do it!

Sources:

Bonds at Your Stage of Life

Not Saving for Retirement at 40? Crazy!

The Middle Years

You Won’t Believe This New Retirement Craze!

Call it what you like – phased retirement, gradual retirement, or flexible retirement – but this craze is only just beginning!

In one of my previous posts I talked about the trend of staying in the workforce longer (Read it here). Basically, I explain that the historical concepts of retirement are becoming more and more out of date. The most obvious reason is the fact that, in the past few generations, the average life expectancy has increased by almost 30 years!

With people living longer, healthier lives, it’s no wonder why they are choosing to stay in the workforce longer. Since we are living longer, the money we save for retirement has to last longer. This causes two effects. One, we need to save more money. Two, we need to work longer. Usually, our solution includes a mixture of those two options.

This is what leads us to the new craze in retirement.

Phased Retirement as I call it (although you may call it whatever you wish), is how the world is evolving to change the historical concept of retirement to meet the needs of this age.

Let me walk you through this relatively new concept that is changing how people, companies, and our government is thinking about retirement.

There is currently a process that people go through when they choose traditional retirement, or “cliff retirement”.

For about 3 years before retiring, you are extremely excited about the concept (especially if your current job is stressful). The first year of retirement is extremely stressful. Once you make the plunge you realize that your new schedule lacks in some key areas. Your built in social network from your job is now gone, your previous identity tied to your career is also gone, not to mention that you often feel as if your new life lacks structure and purpose.

However, the next few years of retirement get better. You find yourself in the “honeymoon phase” of retirement when you find new activities and social groups to become a part of. After the honeymoon phase wears off, you will begin feeling like your routine is boring. Finally, after your discontent wears off, you become content with your retired life.

If this doesn’t sound ideal to you, you’re not alone!

This is why phased retirement is becoming so popular. Very few people want to sit around and watch TV all day after they retire, it’s partially what is pushing so many people to continue working long after the standard retirement age.

Phased retirement gives you the ability to relieve some of the financial burden of retirement, reduce the stress of retirement, enhance your personal fulfillment, and keep ties with your social network through your job, while still giving you time for retirement activities like traveling and spending time with family. Ultimately, phased retirement gives you the time you need to prepare for retirement both financially and emotionally.

At this point you might be thinking, “this is sounding like a great idea, but how do I even start?” Well that’s the thing. While phased retirement also helps employers combat the shortage of employees once boomers start to retire and while the IRS is considering regulations to establish guidelines for creating and administering phased retirement programs, only 6% of companies currently have formal phased retirement systems in place.

However, don’t fear, because I have some tips and tricks for negotiating a phased retirement with your company regardless of if they have any systems in place.

Phased Retirement Helps Your Company

By phasing out of your company, you are giving your supervisor plenty of time to find needed replacements. You are also helping your company cut costs while keeping your unique knowledge at their disposal. Here are a few tips for negotiating a new phased retirement schedule with your supervisor:

-

Offer to work during busy times for your company or when the workload is heavy. Depending on your job, this might be seasonal, during peak hours each day, or on certain days of the week.

-

Offer to mentor younger employees. The last thing your company wants is to lose all of the knowledge you have gained over the years working for them. By mentoring a younger employee (potentially to take your place) your company can be ensured that your eventual retirement will be a smooth transition.

Before Talking to Your Supervisor, Research These Things!

Don’t run into your supervisor’s office before doing your research. Look into the topics below so that you can come up with a solidified plan before reaching out to your supervisor.

-

Watch out for pension/retirement fund problems. Make sure that decreasing your salary won’t adversely effect your pension. If your pension is based on your income over your last five years of work, cutting your salary isn’t the best idea. If this is how your pension is set up, consider “retiring” from your current job on schedule and picking up a new part-time job to transition into retirement.

-

Check the minimum requirements for full health coverage for your company. If you are under the age of 65 (aka, you don’t qualify for medicare) you want to make sure that you will still be working enough hours to receive your full benefits.

-

Look into Social Security withholdings. This is the most complicated step, but don’t worry, I’ve got you covered. First of all, it is important for you to know that you can work and still receive Social Security benefits! That being said, if you are making “too much” for your age bracket things can get a bit more complicated. Before getting into the details, let me give you one extra tip. You will need to know your “full retirement age” according to the Social Security Administration. Click here to calculate your “full retirement age” now. Now that you know your “full retirement age” look below to see where you might fall when you retire and how to best utilize your Social Security Benefits:

-

If you are shifting to phased retirement between the ages of 62 and your “full retirement age”: you can earn $15,720 in 2016 without being penalized. If you are making more than that, it isn’t necessarily a cause for alarm. For each dollar you make above that maximum, Social Security will withhold 50 cents.

-

Once you reach your “full retirement age”: you can earn up to $37,680 per year. If you are making more than that, your penalty goes down to 33 cents for each extra dollar earned.

-

Once you are above your “full retirement age”: you can earn as much as you like with no more penalties or withholding’s.

-

Now, here is the really good news. If you fall into one of the situations where part of your income is being withheld by the Social Security Administration, you will get it back once you are above your “full retirement age”! Once you reach that age, your social security check will be recalculated to give you credit for all of the previously withheld payments! (If you have any more questions about how your Social Security is effected when you start to retire, their website is full of useful information!)

Now that you have done your research, you are ready to talk to your supervisor.

Negotiate Your New Schedule With Your Supervisor

-

Choose your responsibilities carefully. Make sure that you aren’t just “giving up” the responsibilities that you don’t enjoy. Think about which of your responsibilities are the most important for the company. Also, which responsibilities currently need to be required during times when your new schedule might not have you at the company. Set up a schedule to slowly start giving up responsibilities (starting with the ones that require the least extra training for whoever takes those responsibilities over). This is made easier if you are mentoring your eventual replacement.

-

Settle on fair pay. Keep in mind that you are working less. You might have to give up some of your full-time perks as well as some of your income. Don’t be shocked if you’re asked to give up your parking spot right in front. Remember that you are trading your extra income and perks for more personal time to do what you enjoy. Think about what perks are the most important to you as well as how much you should be compensated for your new schedule.

Now you are ready to start your phased retirement journey! The only thing left to do is decide how to enjoy your extra time off!

Sources:

The United States Social Security Administration

WKOW 27: “Gradual Retirement” Growing Across Wisconsin

The Gazette: The “New Retirement” and Why to Try It

U.S. News Money: How to Retire Gradually

AARP: Phased Retirement and Flexible Retirement Arrangements

Who Says You Have to Retire by 65?

You get married, raise a family, work to support your family, and then you retire. That’s just the way it is. Right?

Wrong. Actually, retirement is a fairly new concept; and the concept of retiring in your sixties is even newer.

During the Industrial Revolution, many aging factory workers refused to stop working, even as their ability to work slowly started deteriorating.¹ It wasn’t until the 1930’s that the concept of making people want to retire was born with the Social Security Act. Since then, retirement has continued to evolve and change, but a bigger change is on its way.

According to a new AARP survey, over 50% of people surveyed believe that they will continue working past the age of 65. Now, that doesn’t mean that we never want to retire², instead, we just believe that we still have plenty to contribute to society. We still are skilled at our jobs, actually with all of our knowledge we have gained over the years, we probably know more than we ever have before.

Gone are the days of hitting 65 and expecting our life to be almost over. In the past few generations, the average life expectancy has increased by 29 years and shows no signs of slowing down.³ These days we know that we can still contribute to society, we can still help make the world we live in a better place, and, most importantly, we aren’t going anywhere anytime soon.